- Home

- >

- Blockchain & NFT

- >

- NFT IN A NUTSHELL: EVERYTHING YOU NEED TO KNOW

When searching on the Internet for What is NFT?, we usually get the result as NFT stands for “non-fungible tokens’‘. Of course, we all know NFTs stand for “non-fungible tokens”. It’s like asking what HTML is and receive the answer as HTML stands for The HyperText Markup Language.

What we need are answers to questions like How does it work? What is it? Can you buy some? etc. At InApps Technology, we think of a better way to explain why NFTs were named “non-fungible tokens”. Continue reading for more!

In this week’s column, we’ll cover:

- An easy explanation of NFT, fungibility (with real-life examples)

- How this kind of token can change the entire market’s behavior

- The future of NFTs

Key Summary

This article from InApps Technology, authored by Tam Ho, provides an accessible explanation of Non-Fungible Tokens (NFTs), their underlying blockchain technology, market impact, and future potential. It moves beyond the basic definition of NFTs as “non-fungible tokens” to explore their mechanics, value, and applications. Key points include:

- What Are NFTs?:

- Definition: NFTs are unique digital assets on a blockchain (e.g., Ethereum, NEO, Alice) that cannot be interchanged, unlike fungible assets like the US dollar or Bitcoin.

- Fungibility Explained:

- Fungible assets (e.g., $100 bill) are interchangeable with identical value.

- Non-fungible assets (e.g., houses, cars, NFT art) are unique, with blockchain ensuring traceability and authenticity.

- Example: Unlike Pokemon cards, NFT digital art can be traced to its original creator via blockchain metadata.

- Technology: Blockchain enables digital certificates for unique assets, storing metadata and transaction history publicly, allowing creation, trading, or removal of digital assets.

- Market Impact:

- Applications: NFTs are used in digital art, gaming skins, collectibles, tickets, passports, digital land, birth certificates, identities, and warranties.

- Value Drivers: Scarcity and demand drive NFT value, with notable sales like The First 5000 Days ($69M) and CryptoPunk #3100 ($7.58M).

- Top NFT Sales (as of article date):

- The First 5000 Days ($69M)

- CryptoPunk #3100 ($7.58M)

- CryptoPunk #7804 ($7.57M)

- Crossroad ($6.6M)

- The First-Ever Tweet ($2.9M)

- CryptoPunk #6965 ($1.6M)

- Axie Infinity Virtual Game Genesis Estate ($1.5M)

- CryptoPunk #4156 ($1.5M)

- Forever Rose ($1M)

- Metarift ($904,413)

- NFTs and DeFi:

- Integration: NFTs can be used as collateral in Decentralized Finance (DeFi), e.g., pledging a CryptoPunk to borrow cryptocurrency like 1,000 Gas for 10 NEO.

- Quote (Da Hongfei, NEO CEO, 2018): Highlights NFTs’ role in gaming collectibles on blockchain, enabling trading and ownership verification.

- Future of NFTs:

- Vision: NFTs are part of a shift toward a cashless, blockchain-driven society, potentially using “gas” for transactions like rent.

- Call to Action: Encourages early adoption to prepare for a digital-first future, emphasizing continuous learning and adaptation.

- InApps Insight:

- Aligns with Microsoft’s Azure Blockchain Services and Power Platform, leveraging Power Fx for low-code NFT solutions and Azure Durable Functions for scalable blockchain transactions.

- InApps Technology, ranked #1 in Vietnam for app development, integrates Ethereum, Vue.js, GraphQL APIs (e.g., Apollo), and Azure to build NFT-driven solutions, targeting startups and enterprises with Millennial expectations for innovative, blockchain-based applications.

How can tokens rule the market?

First and foremost, let’s talk about how these tokens can lead in the fast-changing market. Before we go any further, making sure you’ve understood the technology underlying this type of token is important to us.

Let’s talk more about the technology

According to Investopedia: “Fungibility is the ability of a good or asset to be readily interchanged for another of like kind. Like goods and assets that are not interchangeable, such as owned cars and houses, are non-fungible.”

For instance, the fungible asset is the US dollar. If you exchange the $100 bill with the $100 bill of your friend, nothing changes. Those are paper, and the value is the same. On the other hand, the non-fungible asset could be a house, a car, or even a bitcoin.

More example, let’s look at the collectible Pokemon cards and NFT Digital painting. People cannot track, verify, or trace the original creator, but NFT art can. Since NFTs contain distinguishable information (it’s blockchain), therefore making them unique.

Add-on Blockchain to this theory

Blockchain is a technology that allows us to implement many radically new ideas that weren’t possible before. The most successful and powerful token that was created by Blockchain is Bitcoin. Bringing non-fungible assets and Blockchain together lets us create a digital certificate that represents a unique asset. Moreover, this technology makes sure that it cannot be interchanged with something else.

This technology allows people to claim their authority or event trade, sell, buy, remove any digital asset they created. Consequently, those tokens are stored on an open and distributed Blockchain (Ethereum, NEO, Alice, etc.). They could be embedded metadata, transaction history by anyone in the world with an Internet connection.

Up to this point, NFTs are being used in industries like digital art, tickets, passports, collectibles, gaming skins, digital land, birth certificates, identities, warranties, and more.

Furthermore, if you’d like a more in-depth view of Blockchain development, click the picture down below to read more about our previous project!

Why are NFT items valuable?

The NFT digital assets were created and structured individually, thus making every item is the only one. Like other markets, demand and supply play an important role to create the NFT value.

Take a look at the example down below.

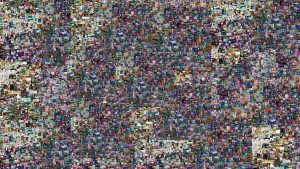

The First 5000 Days, was sold by Christie’s for $69,346,250 (£50 million).

Top ten valuable NFT art sold

Take a quick look at some of the most high-value NFT art sold right now.

- The First 5000 Days ($69 million)

- CryptoPunk #3100 ($7.58 million)

- CryptoPunk #7804 ($7.57 million)

- Crossroad ($6.6 million)

- The First-Ever Tweet ($2.9 million)

- CryptoPunk #6965 ($1.6 million)

- Axie Infinity Virtual Game Genesis Estate ($1.5 million)

- CryptoPunk #4156 ($1.5 million)

- Forever Rose ($1 million)

- Metarift ($904,413)

NFT and DeFi (Decentralized Finance)

“We have had a standard just get approved. It will be merged into our main branch. Non-fungible tokens are also a strategy for NEO. When gaming hits the blockchain, you get collectibles. These collectibles can be traded on the blockchain, so it’s a perfect match.”

— Da Hongfei, CEO of NEO shared some of his thoughts about NFTs in July 2018

There is a DeFi that you can borrow money by collateralizing your cryptocurrency. For example, you can collateralize 10 NEO for loaning 1,000 Gas. The lender can have the NEO if the borrower cannot pay back the debt. When applying together with NFTs, you can make your Crypto Punk as collateral for lending some cryptocurrency.

The future of NFTs

We are the “early bird” of the new world era. Therefore, we must continuously learn, accept and adapt to the digital world, especially Blockchain technology.

Think about the day that our next generation living in a cashless society, paying rent by using “gas.” The early we move, the better for the next generation.

At InApps Technology, we’re optimistic about what the future holds for NFTs. If you don’t act now, when?

Let’s create the next big thing together!

Coming together is a beginning. Keeping together is progress. Working together is success.